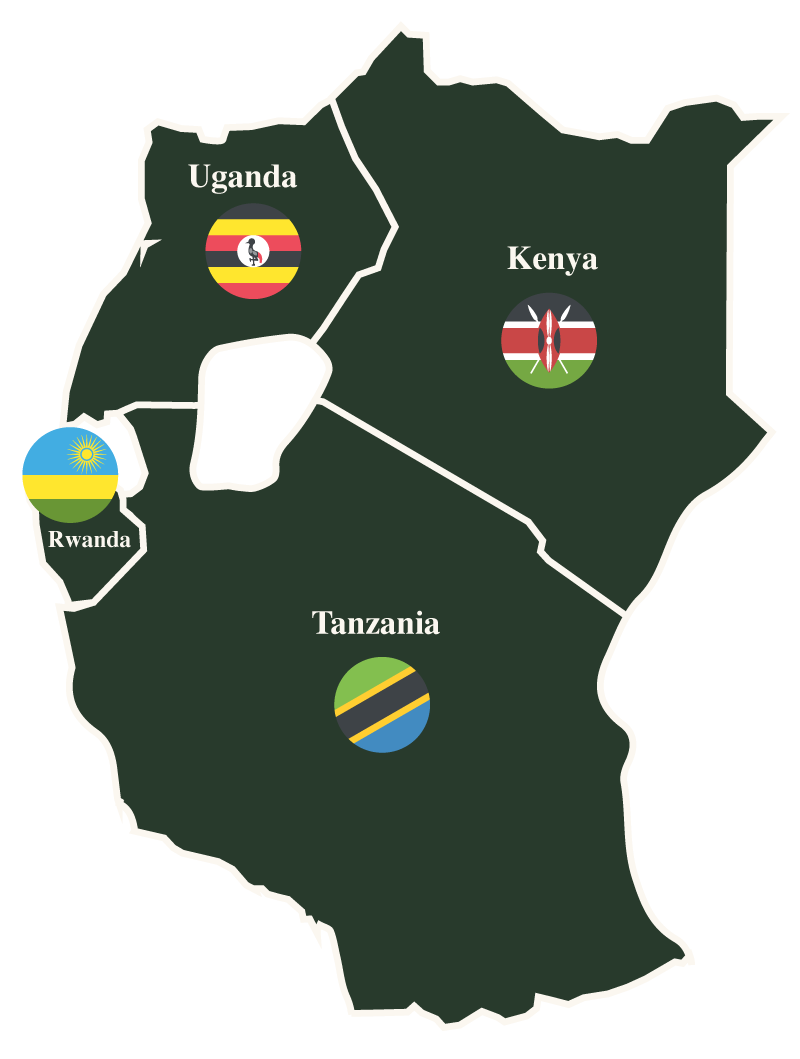

The East African Community (EAC) block, comprising eight partner states with a combined population of 330 million, is one of the fastest-growing regional economic blocs globally. Four countries, Kenya, Uganda, Tanzania, and Rwanda, are major players in the cotton, textile, and apparel value chain. Kenya and Tanzania lead in apparel exports to the USA, while Uganda and Tanzania are major players in cotton production and exports to Asia. The region’s potential for growth is massive due to attractive investment incentives, duty-free access to major markets, enabling infrastructure, and a talented English-speaking population.

Explore East Africa's textiles and apparel industry through data. Get insights, trends, and analytics.

Why Make It East Africa?

The value this website gives

East Africa is the birthplace of mobile money, home to the silicon savanna and the next frontier of innovation, creativity and fashion in Africa and the world.

East Africa at a glance

Kenya, Uganda, Tanzania & Rwanda

East Africa's Green Energy Landscape

Leading the Charge in Sustainable Development

| Country | Resource | Capacity | Reference |

|---|---|---|---|

| Kenya | Geothermal | 943 MW (27%) | IMF (2022) |

| Hydroelectric | 872 MW (25%) | KenGen | |

| Solar | 4 x 40 MW plants (Selenkei, Malindi, Alten, Cedate) | Business Daily (April 2024) | |

| Bioenergy | 114 MW (3.2%) | EPRA Report 2023-2024 | |

| Waste Heat Recovery Cycle | 83.5 MW(2.4%) | EPRA Report 2023-2024 | |

| Thermal | 630 MW (18%) | EPRA Report 2023-2024 | |

| Wind | 436 MW (12.5%) | Rodl & Partner (2021) | |

| Total | 3,690 MW | ||

| Tanzania | Hydroelectric | 200 MW+ (Kidunda & Mtera Dams) | AFISC |

| Thermal | 951.6 MW | International Trade Administration | |

| Rwanda | Hydropower | 123.4 MW | REG (2022) |

| Biomass (Peat) | 155 million tonnes potential, 7% of total generation | ||

| Biomass (Peat Plants) | Gishoma (15 MW), Hakan (80 MW - 40% operational) | ||

| Solar | 12.050 MW | ||

| Uganda | Geothermal | 450 MW (estimated potential) | Sector Brief Uganda |

| Hydropower | 2,000 MW (approx., mid-2021) | Sector Brief Uganda | |

| Bioenergy | 94% of total energy consumption | Sector Brief Uganda |

East Africa, the next frontier in Textile and Garment Manufacturing and Sourcing

East Africa provides a great platform to build better. With ample competitive and trainable labour, an emerging industry and a strong government commitment to growth and development, the region presents a robust and stable platform to develop a vertical sourcing solution within the region.

Kenya 🇰🇪

Kenya is the leading exporter of Apparel to the US Market under AGOA (Exported US$ 544 million in 2022) with the highest concentration and growth in manufacturing capacity. A strong green energy supply with over 95% of Kenya’s electricity supply being renewable.

Cotton sourcing

BT Cotton Conventional, Area under cultivation : 11,700 Ha

Has access to cotton from her immediate neighbors, Tanzania and Uganda who are both net exporters.

Import from the region 8,900 MT Harvest season- Nov-Feb

Smallholder farmers: 6000

Traceability- possible

Demographics

Population: 52 Mio people

Literacy: 83%

Languages: English and Swahili

Avg operator wage:

USD 100-150/m

FX

Open market no restrictions.

FX cover 3 months of GDP.

Tanzania 🇹🇿

The leading producer of cotton in the East Africa region with both organic and conventional cotton. The country also has other natural fibres such as sisal. Tanzania is the second largest garment exporter from East Africa to the US market under AGOA.

Cotton sourcing

Conventional and Organic Cotton

641,000 Ha under cultivation,

141,000 MT produced in 2022

98,000 MT exported in lint. (Approx. 70%)

Season for harvest/sales May – Aug

Demographics

Population: 65 Mio people

Literacy: 82%

Languages: English and Swahili

Avg operator wage:

USD 80- 100/m

FX

Open FX regime for inflows and traders registered with the central bank.

FX cover 3 months of GDP.

Uganda 🇺🇬

Known as “The Pearl of Africa” Uganda offers an unparalleled opportunity to set up a fully vertical operation.

Cotton sourcing

Conventional and Organic Cotton

104,000 Ha under cultivation,

45,000 MT produced in 2022

33,000 MT exported in lint. (Approx. 73%)

Season for harvest/sales May – Aug

Two crops per year

Demographics

Population: 47 Mio people

Literacy: 79%

Languages: English and various indigenous

Avg operator wage:

USD 60- 120/m

FX

Open market no restrictions.

FX cover 5 months of GDP.

Rwanda 🇷🇼

Africa’s safest cities, modern country and an investment environment built for creativity, innovation and large scale garment manufacturing.

Cotton sourcing

Conventional and Organic Cotton

Rwanda has access to cotton from her immediate neighbors, Tanzania and Uganda who are both net exporters.

Demographics

Population: 13 Mio people

Literacy: 76%

Languages: English and French

Avg operator wage:

USD 60- 120/m

FX

Open market no restrictions.

FX cover 5 months of GDP.

East Africa's manufacturing industry showcases resilience and innovation, with a growing focus on sustainable practices and the production of eco-friendly products.

Regional Fabric Mills

Leading manufacturers of textiles

Thika Cloth Mills 🇰🇪

Rivatex 🇰🇪

Ken Knit 🇰🇪

Red Earth 🇹🇿

Bedi Investments 🇰🇪

Fine Spinners 🇺🇬

Nytil 🇺🇬

What does sustainability in the textile and apparel industry involve and how do the benchmark countries compare?

Resources

Useful downloads, resourceful website, and much more

In this section, you’ll discover a curated collection of downloadable assets, ranging from insightful e-books to handy templates, aimed at providing you with practical solutions and knowledge. Navigate through our carefully compiled list of recommended resource websites, handpicked to serve as invaluable references across various domains. Whether you’re seeking educational materials, productivity tools, or creative inspiration, we’ve got you covered.

Data Sources

Make It East Africa was pioneered by Gatsby Africa

Make It East Africa Blog

News Articles & More

Dive into the heart of the industry with our cutting-edge blog, where we unravel the latest trends, insights, and data shaping the future of textiles. Immerse yourself in a tapestry of articles that explore everything from sustainable fashion revolutions to the technological breakthroughs defining the modern wardrobe. Our blog is your gateway to a treasure trove of information, offering a glimpse into the dynamic landscape of textile and apparel.